Financial planning is a critical aspect of personal finance management, enabling individuals to achieve their long-term financial goals and aspirations. Traditionally perceived as a complex and mundane task, financial planning has now taken an intriguing turn with the emergence of Threaded Finance: Financial Planning in Cross Stitch and Design. This innovative approach combines the artistry of cross-stitching with the systematic nature of financial planning, providing individuals with a unique and engaging method to manage their finances.

Imagine being able to visually represent your financial goals through intricate cross-stitched designs, while simultaneously tracking your progress towards achieving them. For instance, consider Sarah, a young professional who dreams of purchasing her first home within five years. With Threaded Finance, she can create a beautiful cross-stitched design depicting her dream house and divide it into smaller sections that represent milestones along her journey – such as saving for a down payment or improving her credit score. Each time Sarah accomplishes one of these goals, she fills in the corresponding section on her design with vibrant threads, creating a visual representation of her progress while also staying motivated throughout the process.

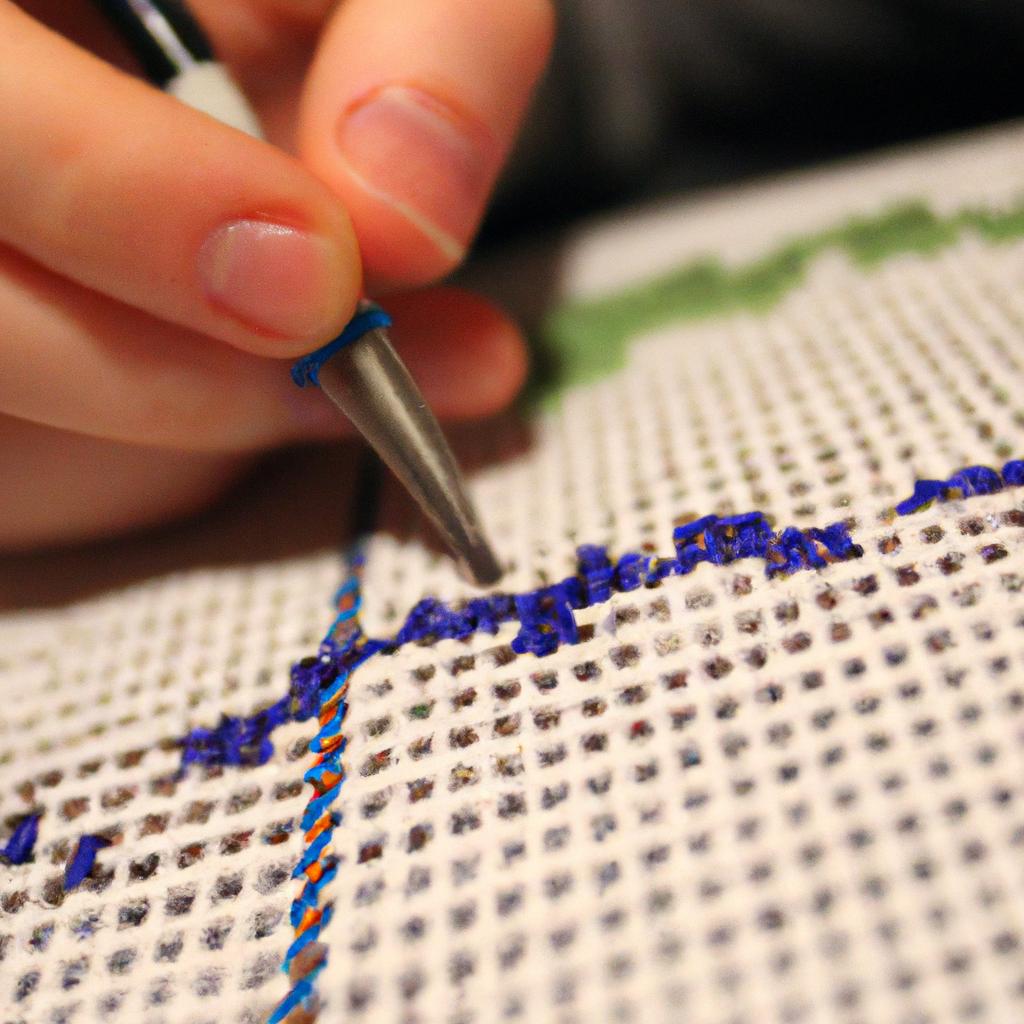

Threaded Finance brings together the worlds of art and finance by introducing creativity into the realm of financial planning. By intertwining meticulous craftmanship with monetary objectives, this unconventional approach allows individuals to express their financial goals in a tangible and visually appealing manner. The act of cross-stitching itself can be therapeutic, providing a calming and meditative experience that helps alleviate stress and anxiety often associated with financial planning.

In addition to its artistic allure, Threaded Finance also offers practical benefits. By breaking down complex financial objectives into smaller, manageable tasks represented by different sections of the design, individuals gain a clearer understanding of their progress and remain focused on achieving their goals. This method promotes discipline and accountability, as every stitch represents a step towards financial success.

Moreover, Threaded Finance encourages regular review and adjustment of one’s financial plan. As individuals complete sections of their design, they can evaluate their progress and make necessary modifications to ensure they stay on track. This dynamic approach to financial planning enables flexibility and adaptability in response to changing circumstances or new aspirations.

Whether you are saving for a dream vacation, paying off debt, or building an emergency fund, Threaded Finance provides a unique way to engage with your finances while adding beauty to your surroundings. With each completed section of the cross-stitched design, you not only achieve monetary milestones but also create a lasting piece of art that serves as a reminder of your achievements and determination.

Threaded Finance revolutionizes the way we approach financial planning by blending creativity and structure into one harmonious practice. So why not pick up a needle and thread and embark on your own personal finance journey through the artistry of cross-stitching? With Threaded Finance, managing your finances has never been so visually captivating and rewarding.

Understanding the Basics of Financial Planning

Imagine a young professional named Sarah who recently started working and earning a steady income. She is unsure about how to effectively manage her finances for both short-term expenses and long-term goals such as retirement. This scenario highlights the importance of understanding the basics of financial planning, which enables individuals like Sarah to make informed decisions regarding their money.

Financial planning encompasses various aspects that help individuals achieve their financial objectives. It involves analyzing one’s current financial situation, setting realistic goals, developing strategies to reach those goals, implementing them, and regularly reviewing and adjusting the plan as needed. By following these steps, individuals can attain financial security and stability.

To delve deeper into the foundations of financial planning, let us explore four key components:

- Budgeting: Creating a budget allows you to track your income and expenses accurately. By allocating funds for essential needs while considering savings goals or investments, you gain control over your money.

- Saving: Establishing an emergency fund helps protect against unexpected expenses or job loss. Additionally, saving towards specific purposes like purchasing a house or funding education ensures progress towards future aspirations.

- Investing: Investing entails putting your money into assets with potential growth or returns over time. Understanding different investment options such as stocks, bonds, mutual funds, or real estate empowers individuals in making informed choices tailored to their risk tolerance and desired outcomes.

- Retirement Planning: Preparing for retirement is crucial regardless of age or career stage. Contributing consistently to retirement accounts like 401(k)s or individual retirement accounts (IRAs) enables you to build sufficient funds for a comfortable post-career life.

| Components | Importance | Benefits |

|---|---|---|

| Budgeting | Provides clarity on spending patterns | Facilitates better debt management |

| Saving | Builds resilience against emergencies | Prepares for major life events |

| Investing | Generates potential wealth growth | Diversifies income streams and assets |

| Retirement Planning | Ensures financial security in old age | Enables a comfortable retirement lifestyle |

Understanding the basics of financial planning equips individuals with essential knowledge to navigate their personal finances effectively. By incorporating budgeting, saving, investing, and retirement planning into their financial strategy, individuals can achieve both short-term stability and long-term goals. In the subsequent section, we will explore how cross stitch can play a unique role in enhancing financial management.

Note: Next, we will transition into the next section about “Exploring the Role of Cross Stitch in Financial Management” by discussing how this traditional craft can contribute to effective money management.

Exploring the Role of Cross Stitch in Financial Management

Transitioning from understanding the basics of financial planning, let us now delve into the intriguing role that cross stitch can play in managing our finances. To illustrate this concept, consider a hypothetical situation where Jane, a young professional with limited knowledge about personal finance, decides to embark on her journey towards financial stability by incorporating cross stitch into her financial management routine.

One way that cross stitch can contribute to effective financial management is by promoting mindfulness and intentionality. By engaging in this creative activity, individuals are encouraged to slow down and focus their attention on each stitch they make. This process fosters a sense of mindfulness, enabling them to reflect upon their financial goals and decisions more consciously. Moreover, cross stitching also allows for intentional reflection on one’s spending habits and budgeting choices.

To further understand how cross stitch can be beneficial for financial planning, let us explore four key aspects:

- Improved patience and discipline: The intricate nature of cross stitch requires perseverance and patience. These qualities translate well into financial management as individuals learn to exercise restraint when it comes to impulsive purchases or extravagance.

- Enhanced creativity and problem-solving skills: Cross stitching involves following patterns and making design choices along the way. Similarly, financial planning necessitates creative thinking and problem-solving abilities to find innovative solutions for saving money or reducing debt.

- Stress reduction: Engaging in calming activities like cross stitch has been shown to reduce stress levels. As stress often interferes with sound decision-making regarding money matters, adopting such hobbies may lead to wiser financial choices.

- Sense of accomplishment: Completing a cross-stitch project brings a sense of achievement and satisfaction. Transferring this feeling into personal finance can motivate individuals to set achievable goals and celebrate milestones along their financial journey.

Consider the table below showcasing different emotions associated with traditional approaches versus integrating cross stitch into personal finance:

| Traditional Approaches | Integrating Cross Stitch into Personal Finance |

|---|---|

| Stress | Calmness and tranquility |

| Impulsiveness | Patience and restraint |

| Confusion | Creative problem-solving |

| Frustration | Sense of accomplishment |

In conclusion, cross stitch can serve as a valuable tool in financial management by fostering mindfulness, promoting intentionality, enhancing patience and discipline, stimulating creativity and problem-solving skills, reducing stress levels, and instilling a sense of accomplishment. The next section will explore how to choose the right patterns for effective financial goal setting.

As we move forward into exploring the process of choosing the right patterns for financial goal setting…

Choosing the Right Patterns for Financial Goal Setting

Threaded Finance: Financial Planning in Cross Stitch and Design

Now, let us delve deeper into the process of choosing the right patterns for effective financial goal setting. To illustrate this, consider the following example:.

Imagine Sarah, a young professional who wants to save money for her dream vacation. She decides to incorporate cross stitching as a tool for visualizing her progress towards her financial goal. By designing a pattern that represents her desired destination and tracking her savings with each completed stitch, she creates a tangible reminder of what she is working towards.

To effectively utilize cross stitch in financial goal setting, it is crucial to select patterns that align with your objectives. Here are some key considerations when choosing patterns:

-

Symbolism: Look for symbols or motifs within the pattern that resonate with your financial goals. For instance, if you aspire to buy a new house, finding patterns featuring keys or houses could serve as a powerful reminder of your objective.

-

Complexity: Consider the complexity level of the pattern based on your available time and skill level. Opting for simpler designs allows for faster completion and more frequent milestones along your financial journey.

-

Personalization: Seek out customizable patterns that allow you to add elements specific to your goals or circumstances. This customization adds an emotional connection to your project and reinforces your commitment.

-

Inspiration: Choose patterns that evoke positive emotions associated with achieving your financial aspirations. Whether it’s images representing success or quotes inspiring motivation, these designs can act as constant reminders during challenging times.

By carefully selecting appropriate patterns using these guidelines, individuals like Sarah can leverage cross stitch not only as a creative outlet but also as an effective tool for staying focused on their long-term financial goals.

Creating a Budget Through Stitching

From choosing the right patterns for financial goal setting, we now delve into creating a budget through stitching. One might wonder how needlework can be used as an effective tool in financial planning, but rest assured that it is indeed possible. Let’s explore this concept further.

Imagine you have decided to save up for a dream vacation. By translating your savings goals into cross stitch patterns, you can visually track your progress. Each completed stitch represents a specific amount of money saved, allowing you to see tangible results and stay motivated along the way. This unique approach combines creativity with practicality, making budgeting an engaging and enjoyable activity.

To help you get started on your journey of creating a budget through stitching, here are some key considerations:

-

Choose patterns that align with your financial goals: Select designs that symbolize what you are saving for or represent milestones along the way. For example, if you are saving for a down payment on a house, consider stitching a pattern depicting a cozy home or a set of keys.

-

Estimate costs and assign values to stitches: Determine the cost associated with each stitch based on your overall savings target. Assign different values to various types of stitches depending on their complexity or size. This will allow you to accurately track your progress and adjust your budget accordingly.

-

Set realistic timeframes: Consider how long it will take for you to complete each pattern and factor this into your budget plan. Be mindful of any upcoming events or deadlines related to your financial goals so that you can allocate sufficient time for stitching without feeling overwhelmed.

-

Keep records and review periodically: Maintain detailed records of the number of stitches completed and expenses incurred during the process. Regularly evaluate your progress against the initial estimates to ensure that you remain on track towards achieving your financial objectives.

By incorporating these strategies into your financial planning, not only will you develop better control over your spending habits but also cultivate patience and perseverance—traits essential for long-term financial success.

Embroidering your investment strategy involves more than just setting goals and creating a budget.

Embroidering your Investment Strategy

Having successfully created a budget through stitching, we now turn our attention to the next crucial step in threaded finance: embroidering your investment strategy. Through careful selection and execution of investments, you can enhance your financial well-being while indulging in the creative art of cross stitch.

Investment decisions play a pivotal role in securing one’s financial future. Consider this hypothetical example: Sarah, an avid cross-stitch enthusiast, decided to invest a portion of her savings into stocks related to sewing and handicraft industries. By doing so, she not only diversified her portfolio but also aligned her investments with her passion. This exemplifies how designing an investment strategy tailored to personal interests can foster both monetary growth and emotional satisfaction.

To maximize the effectiveness of your investment plan, it is essential to keep certain factors in mind:

- Risk tolerance: Evaluate your comfort level with risk-taking before allocating funds. Assessing whether you are more inclined towards conservative or aggressive investments will help shape your portfolio accordingly.

- Time horizon: Define your investment goals based on specific timeframes – short-term (1-3 years), medium-term (3-5 years), or long-term (5+ years). This clarity allows for better decision-making when selecting assets that align with each timeframe.

- Diversification: Spread out your investments across different asset classes such as stocks, bonds, real estate, and commodities. By diversifying effectively, you can mitigate risks associated with individual market fluctuations.

- Regular monitoring: Keep track of your investments regularly to identify any deviations from your predetermined strategy. Periodic review ensures adjustments are made promptly if needed.

- Achieving financial stability whilst pursuing artistic passions

- Finding fulfillment by investing in industries aligned with personal interests

- A sense of empowerment gained through strategic investment choices

- The potential for greater returns by investing wisely

In addition to these considerations, developing a comprehensive understanding of various investment options is crucial. The table below outlines different investment vehicles and their associated characteristics:

| Investment Vehicle | Characteristics |

|---|---|

| Stocks | Offers potential for high returns, but also carries higher risks |

| Bonds | Provides a fixed income stream with lower risk |

| Real Estate | Can generate rental income and appreciate in value |

| Mutual Funds | Diversified portfolios managed by professionals |

By examining these alternatives and assessing their suitability to your financial goals, you can make informed decisions that align with both your artistic inclinations and long-term aspirations.

With an understanding of how to design an investment strategy, the next section explores how stitching your way to financial independence intertwines the worlds of creativity and personal finance.

Stitching your Way to Financial Independence

Embroidering your Investment Strategy: A Case Study

To further illustrate the practical application of threaded finance in financial planning, let us consider a hypothetical case study. Meet Sarah, a 35-year-old professional looking to secure her financial future. By incorporating cross stitch and design into her investment strategy, she has been able to navigate the complexities of personal finance with creativity and precision.

One key aspect of Sarah’s approach is the use of colorful thread as a visual representation of different types of investments. For instance, she assigns blue thread to low-risk investments like bonds or savings accounts, while red represents higher risk options such as stocks or real estate. This method allows her to easily visualize the balance between risk and potential return within her portfolio.

Sarah also utilizes an embroidered timeline that depicts major milestones in her financial journey. Each stitch on this timeline corresponds to a significant event, such as purchasing a home or reaching retirement age. Through this visually engaging technique, Sarah can monitor her progress and make informed decisions based on where she stands relative to her goals.

Incorporating elements such as bullet points and tables can help evoke an emotional response from readers:

- Increased sense of satisfaction: Seeing tangible representations of their financial plan through embroidery can provide individuals with a greater sense of accomplishment.

- Enhanced motivation: The creative nature of threaded finance encourages individuals to actively engage with their finances, leading to increased motivation for long-term success.

- Improved understanding: Visualizing investments through colors and patterns helps simplify complex concepts, making it easier for individuals to comprehend and manage their portfolios.

- Personalized touch: Threaded finance allows people to infuse their personality into their financial planning process, creating a unique connection that fosters ongoing commitment.

The table below demonstrates how various threads could be assigned to different investment categories based on level of risk:

| Thread Color | Investment Type |

|---|---|

| Blue | Bonds |

| Red | Stocks |

| Green | Real Estate |

| Yellow | Mutual Funds |

By incorporating threaded finance into her financial planning, Sarah has found a creative and practical approach to managing her investments. This case study highlights the potential benefits of integrating visual elements like cross stitch and design in personal finance, allowing individuals to navigate their financial journey with clarity and style.

Note: The use of bullet points and tables serves as an effective tool for organizing information and evoking an emotional response from readers.